Snowflake (SNOW -0.55%) has turned out to be a terrible investment in the past few years with shares of the cloud data platform provider down 42% since it went public in September 2020.

However, it has been delivering terrific revenue growth thanks to the healthy demand for its cloud-based data platform that serves fast-growing niches such as data warehousing, machine learning, data engineering, and cybersecurity. As it turns out, the company’s total addressable market has tripled since its initial public offering to a whopping $248 billion.

So could this be an opportunity for investors? Here’s why I think Snowflake stock has massive upside ahead.

Snowflake could deliver terrific long-term growth

According to a consensus estimate of 39 analysts covering Snowflake, the stock carries a median price target of $180. That points toward a 23% jump from Snowflake’s current stock price. However, the Street-high price target of $500 indicates that this cloud stock could soar a massive 241% from current levels.

But can Snowflake put its past underperformance behind it and clock such terrific gains? Well, the company’s slowing pace of growth suggests otherwise. The company is anticipating 40% revenue growth in fiscal 2024 to $2.7 billion. Though that’s nothing to sneeze at, it is worth noting that Snowflake grew at a much faster pace of 70% last fiscal year.

CEO Frank Slootman pointed out on last month’s earnings conference call that Snowflake “saw a measure of bookings reticence with certain customer segments in Q4, reflecting a lack of visibility in the business and preferring a cautious short-term stance versus larger, longer-term contract expansions.”

This is an industry-wide problem as cloud spending growth has hit a speed bump of late. Microsoft‘s Azure cloud service recorded 31% growth in the fourth quarter of 2022, down from 35% in the previous quarter. Amazon‘s Amazon Web Services growth also dropped to 20% in Q4 2022 from 28% in the prior quarter. Headwinds such as strong inflation, a possible recession, and high interest rates have led customers to pull back on their cloud spending of late.

However, it would be prudent to focus on the big picture as the slowdown is likely to be temporary. IDC estimates that the public cloud market could clock annual growth of 26% through 2026, which won’t be surprising as enterprises increase public cloud storage. Meanwhile, the niches that Snowflake serves are also built for terrific growth as its massive addressable market indicates.

For instance, the data warehouse-as-a-service market is expected to clock annual growth of 23% through 2030, according to Polaris Market Research. The data science platform space, on the other hand, could clock 16% annual growth through 2030 and generate close to $380 billion in annual revenue thanks to the proliferation of artificial intelligence (AI) and machine learning.

The good part is that Snowflake is among the leading players in these markets. The company controls a 29% share of the data warehousing market, comfortably ahead of second-place SAP, which has a 23% share. Not surprisingly, Snowflake is rapidly building a solid customer base. The company had 7,828 customers at the end of the last quarter, an increase of 31% over the prior year.

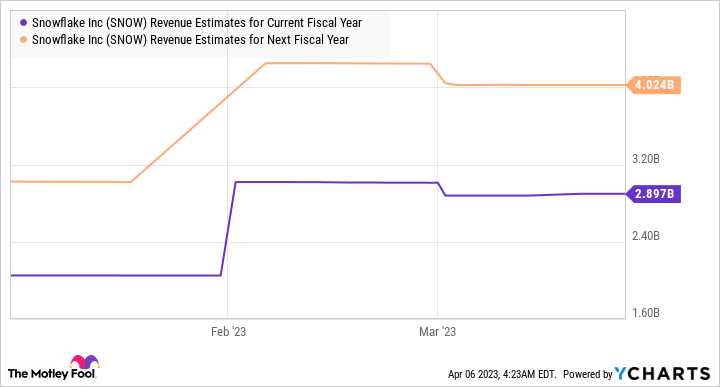

But more importantly, the number of customers spending at least $1 million on Snowflake’s offerings increased at a much greater pace of 79% year over year last quarter. This explains why the company has a solid revenue pipeline with $3.7 billion in remaining performance obligations (RPO) at the end of the previous quarter. That’s much bigger than the company’s fiscal 2024 revenue forecast. Also, Snowflake is expected to maintain solid top-line growth momentum in the next fiscal year.

SNOW Revenue Estimates for Current Fiscal Year data by YCharts

Should you buy the stock?

Though Snowflake stock has underperformed since it went public, investors looking for a growth stock may want to consider it given that it is trading at a much cheaper valuation today as compared to when it went public. Snowflake now has a price-to-sales ratio of about 23. While that’s expensive, it’s much lower than in 2020 when it was trading at a whopping 163 times sales. The following chart shows why growth-oriented investors may want to start accumulating Snowflake.

SNOW PS Ratio data by YCharts

However, Snowflake’s rich valuation also makes it susceptible to volatility, especially if there are signs of weakness in its growth story. But a pullback will open an opportunity for investors with a lower appetite for risk to buy this cloud stock at a relatively cheaper valuation, and they may not want to miss such a chance given the upside Wall Street sees and the lucrative growth opportunity.