With Tesla‘s (TSLA -0.48%) fourth-quarter earnings report coming up next week, investors will likely be looking for an update on management’s expectations for vehicle deliveries this year. After all, recent price cuts suggest that demand could be weakening as interest rates rise, making vehicle affordability more difficult for those who finance their purchases. Getting an update on management’s expectations for deliveries for the full year, therefore, is important.

While what Tesla says about vehicle sales, vehicle demand, and its forecast for vehicle deliveries for the rest of the year may be the most important thing to watch when the electric car maker reports earnings on Wednesday, there are still some other key areas that investors should check on, too. For instance, one area of Tesla’s business that is easy to underestimate is the company’s fast-growing energy segment. Though it represents only a small sliver of the company’s sales today, it’s growing like crazy. Even more, its strong growth may persist even in an uncertain macroeconomic environment.

Let’s take a closer look at this small but important business segment.

Tesla’s energy business

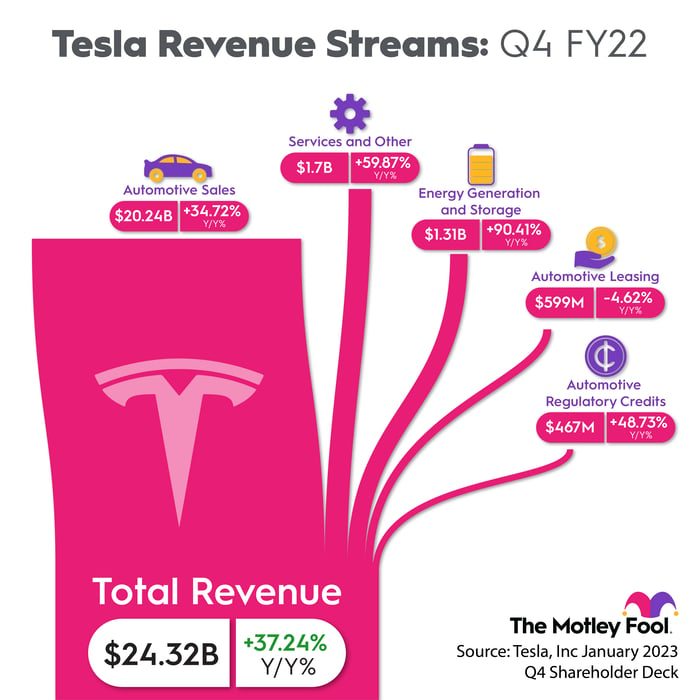

Though Tesla’s Q4 automotive revenue growth of $20.2 billion was a huge jump from the $15.0 billion it reported in the year-ago period, this 34.7% growth significantly lagged the company’s growth rate in its energy business. Tesla’s energy business, which includes sales from both solar products and energy storage products, saw revenue soar more than 90% year over year to $1.3 billion.

This segment’s growth was driven by a 152% year-over-year increase in energy storage deployments, measured by gigawatt hours deployed, and an 18% year-over-year increase in solar deployments, measured in megawatts.

Zooming in on Tesla’s energy storage business, which will likely outpace solar sales for the foreseeable future, Tesla deployed 2.5 gigawatt hours (GWh) of energy storage in Q4 and a total of 6.5 GWh for the full year of 2022. This was up from about 4 GWh in 2021.

Why rapid growth should persist

There are several reasons to expect more strong growth in Tesla’s energy business throughout 2023.

First and foremost, Tesla said in its Q4 update that demand for its storage products “remains in excess of our ability to supply.” To address this challenge, the company is ramping up production of energy storage products at its factory in Lathrop, California, where Tesla plans to eventually produce up to 40 GWh of capacity annually.

“This factory should help to further accelerate growth of energy storage deployments,” Tesla said in its Q4 update.

In addition, with utility companies being the largest customer of Tesla’s energy storage products, it’s worth noting that this customer is likely to be largely unaffected by an uncertain macroeconomic environment. Utilities are known for their stable revenue streams throughout most macroeconomic environments. With stable and predictable businesses, utilities are unlikely to dramatically reduce their appetite for capital projects, particularly if those projects have the potential to eventually save them money or could prevent power outages that would negatively impact revenue.

While investors shouldn’t count on growth in Tesla’s energy business to remain as strong as it has been recently, they also shouldn’t rule it out. Tesla management has emphasized for some time that its energy storage business is growing faster than its automotive sales and is becoming increasingly important to the overall business. In 2023, the company plans to not only emphasize sales growth in its energy business but also cost efficiencies. This means the business could not only see strong revenue growth in 2023 but an improvement in its operating margin, too.

Investors will get more insight into this business when Tesla reports earnings after market close on Wednesday, April 19.