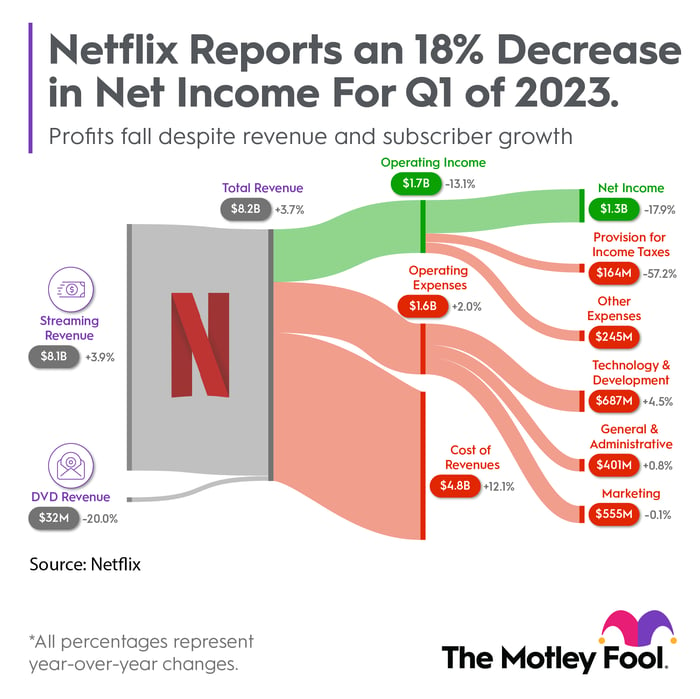

Netflix (NFLX -3.17%) stock was down following its first-quarter earnings report on April 18. While profits were slightly better than Wall Street expected, the company delivered revenue guidance for the next quarter that was below expectations. Since more than doubling from its lows last year, the stock is up 9.5% so far this year.

The market had anticipated a stronger outlook, given Netflix is in the process of rolling out paid sharing and ad-supported plans that are designed to boost the number of paying users on the service. But Netflix is delaying the broader rollout of paid sharing until the third quarter, which means the revenue benefit will be pushed back.

Given that revenue only increased by 4% year over year (8% excluding currency changes), investors are understandably anxious to see better revenue growth. Instead, management said to expect more of the same next quarter.

From a long-term perspective, there’s a more important story here. While Netflix’s near-term guidance might have been disappointing, the extra revenue from these initiatives is paving the way for Netflix to upgrade the user experience and drive higher long-term growth in revenue and profits.

Content is the answer

It’s well documented at this point that Netflix is the king of the hill in streaming. Once again, the company beat its chest by showing that it continues to rank toward the top in key markets in total viewing time, according to data from Nielsen. Despite increasing competition, Netflix is holding its own, coming in just behind YouTube’s 8% share of viewing in the U.S. market but well ahead of other top streaming services.

Its relatively small 7% share of viewing time is why Netflix believes there is a long runway of growth ahead. While the company’s optimism might not fit the recent trend of slowing revenue and subscriber growth, it wouldn’t be surprising to see subscriber growth accelerate again over the next several years. The future of entertainment is headed toward streaming platforms, and Netflix still has the upper hand in the most important area needed to win: content.

The wide variety of content allows Netflix to meet the tastes of everyone, which is crucial to remaining on top. A wave of new releases in the second half of last year is why Netflix was able to return to growth after posting subscriber declines in the first half of 2022. Netflix has grown its paid memberships for three consecutive quarters now, with year-over-year growth accelerating to 4.9% in the first quarter, up from 4% in the fourth quarter.

By focusing on Netflix’s content leadership, investors would have recognized the buying opportunity in the stock when it fell to a 52-week low of $162.71 last year. But another buying opportunity could be presenting itself based on what management had to say about the early results of advertising and paid sharing.

What really matters

The key to retaining its leadership in content is revenue growth, which funds all the company’s spending. This is why the rollout of paid sharing and ad-supported viewing are still major catalysts for the stock.

There are a few positives from the earnings report that suggest an acceleration in revenue growth is around the corner. First, in the U.S. market, the average revenue per membership in the ad-supported plans is already trending higher than those members on standard membership plans.

Second, some investors have been concerned that the rollout of paid sharing will cause cancellations and pressure Netflix’s subscriber growth, but this hasn’t happened so far. In Canada, for example, the number of paid memberships are now larger than before the launch of paid sharing, and management expects a similar outcome once paid sharing is more broadly introduced in the U.S. market.

Funneling more revenue into a better user experience

The important thing about these initiatives is how they will ultimately improve every aspect of Netflix’s service. For example, management cited “healthy performance and trajectory of our per-member advertising economics” for upgrading the ad-supported plans with higher quality 1080p video.

Netflix is funneling the extra profit and revenue from paid sharing and ads to upgrade the user experience. This will improve member retention, lead to more quality content for everyone to enjoy, and protect the company’s lead in streaming.

Based on management’s guidance, these initiatives are expected to accelerate top-line growth in the second half of the year. This is getting lost in the quarterly noise of earnings misses and subscriber shortfalls. Investors who focus on the long-term initiatives that really matter to this streaming stock will be in the best position to make profitable investment decisions.