We all love watching our favorite stocks rise — and seeing our portfolios follow along. But whether that happens or not during a given period, we still can make money from our investments. In fact, we can generate cash by doing nothing at all.

Sound like a dream? Well it’s actually a reality if you hold stocks that pay dividends. One of those stocks is healthcare giant Johnson & Johnson (JNJ -0.54%). In fact, J&J is part of a group of companies known as Dividend Kings that have raised their dividends for at least the past 50 years. And this week, J&J made an announcement that any dividend investor would love.

A top priority

J&J, while reporting earnings, said that dividend payments remain one of the company’s priorities — and lifted its dividend by 5.3%. This is the company’s 61st year of annual dividend increases. So, as we can see, it’s well into Dividend King territory.

This long-term trend is important because it shows J&J’s commitment to sharing the wealth with investors. When a company is this engaged in dividend increases, it’s likely to continue along that path.

J&J’s move brings the company’s annual dividend to $4.76 per share, for a current dividend yield of 2.9%. This is well above the pharmaceutical industry’s average yield (as of January) of 2.15%, according to data from the NYU Stern business school.

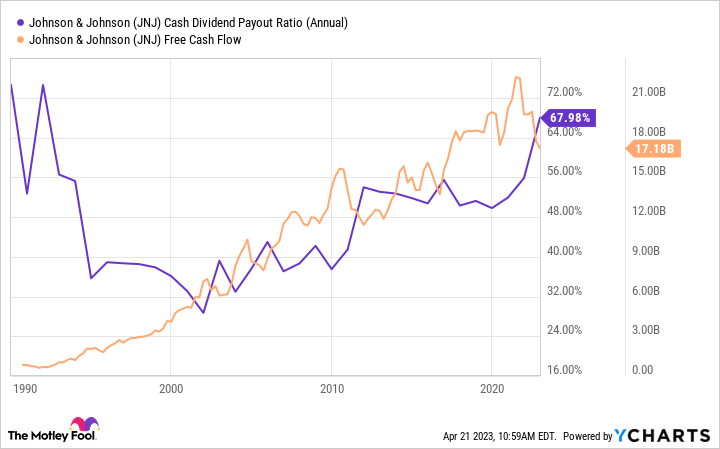

J&J’s cash dividend payout ratio shows it paid out about 67% of its free cash flow in dividends over the past year. And J&J’s massive level of free cash flow indicates the company has what it takes to continue raising dividends:

JNJ Cash Dividend Payout Ratio (Annual) data by YCharts.

All of this means that J&J continues to be a stock that dividend investors should favor. In the first quarter, J&J paid out $2.9 billion in dividends.

But J&J has a second way of rewarding shareholders — it also prioritizes share buybacks. In the most recent quarter, it completed a $5 billion share repurchase plan. This is positive for multiple reasons: It shows that the company is confident in its future. The move of retiring some shares from the market can boost the stock price. And buybacks also lift earnings per share.

An earnings track record

By now, J&J probably sounds like a terrific dividend stock, and it is. But the story gets even better; you won’t want to buy the stock only for dividends and buybacks. The company also has a solid earnings track record.

J&J even raised its guidance for the full year 2023 after a “strong start to the year.” It now forecasts an increase in operational sales growth in the range of 5.5% to 6.5%. That’s up from an earlier estimate of 4.5% to 5.5%.

And growth may get a lift later on this year when J&J spins off its smallest business — consumer health — to focus on pharmaceuticals and medtech. Pharmaceuticals and medtech contribute the most to the company’s revenue.

At the same time, J&J makes investing in research and development a focus too; the company currently has more than 100 candidates in the pipeline. And J&J invested $3.6 billion in R&D in the quarter, up by nearly 3% from the year-earlier period.

So what does all of this mean for you? Johnson & Johnson may not be a high-growth stock like a young biotech player. But the big pharma company has delivered increasing earnings over time — and is taking steps today to ensure that that continues. At the same time, J&J pays you just for owning shares of the company, and has a solid track record of lifting those payments. All of that sounds like a great deal for any long-term investor.