The last year and a half has turned out to be a hard reset for the investing landscape. Gone are the days of high-flying speculative investments fueled by easy money.

Instead, investors on balance have been circling back to companies with lengthy operating histories, solid free cash flow, and proven business models. Elite dividend programs have also been a central theme in this ongoing shift to value.

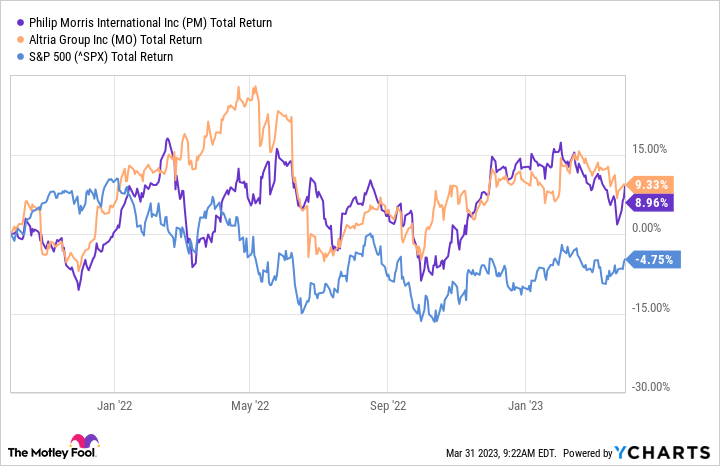

Tobacco giants Altria (MO 0.27%) and Philip Morris International (PM 0.65%) are prime examples of this evolving value tilt. Thanks to their well-above-average dividend yields (8.45% and 5.26%, respectively), these legacy tobacco companies have generated total returns on capital far in excess of the broader markets over the last 18 months.

PM total return level data by YCharts.

Which of these high-yield dividend stocks represents the better overall value play right now? Let’s break down the outlook for each company.

The case for Altria

American tobacco behemoth Altria has long been a company in search of a value driver. With price increases yielding diminishing returns due to the shrinking market for combustible tobacco, Altria spent $12.8 billion for a 35% economic stake in the vaping company Juul in 2018, $1.8 billion for a 45% ownership stake in marijuana company Cronos Group in 2019, and more recently $2.75 billion on U.S. vape manufacturer Njoy Holdings.

Altria has since written off most of its Juul investment and halted further investment in Cronos Group in light of the enormous struggles of the legalized cannabis market.

Despite these headwinds, Altria is still projected to modestly grow its top line over the next 24 months by about 3%. And the U.S. tobacco market leader has shown its dedication to paying an elite dividend by increasing payouts at a compound annual rate of 4.1% over the past five years. Altria has also raised its dividend 57 times over the prior 53 years.

So despite a somewhat elevated payout ratio, Altria can probably be counted on as a sustainable and steadily growing source of passive income — at least in the short term. Over the long term, the tobacco company might need its Njoy investment to pan out in order maintain its top-shelf dividend.

The case for Philip Morris

Like Altria, Philip Morris is a company in transition. Despite owning international rights to premium cigarette brands like Marlboro, Philip Morris is in the process of shifting its entire business to smoke-free alternatives such as heated tobacco, e-vapor, and oral smokeless products. The company wants more than half of its net revenue to come from smoke-free alternatives by 2025.

This ambitious goal is a bold strategic objective that shows management is indeed serious about moving away from combustibles as a main revenue driver. Wall Street, for its part, thinks this purpose-driven tilt into heated tobacco and other smokeless alternatives will be an enormous growth driver for the company. Over the next two years, for instance, Philip Morris’ top line is projected to grow by 18.4% in response to this strategic shift.

On the dividend front, Philip Morris has increased its payout for 15 straight years and has grown the payout by 176% since 2008. With sales and free cash flow set to spike in the coming years, the company’s top-shelf dividend appears to be on stable financial ground, despite its hefty 86% trailing-12-month payout ratio.

Verdict

Philip Morris is the clear winner in this head-to-head match. Although the company’s dividend yield is lower than Altria’s, its long-term outlook is considerably more attractive as a result of its success in smoke-free alternatives.

Altria, on the other hand, still has work to do to shore up both its core and deep value propositions. In short, Philip Morris stock offers superior overall value to Altria.