What happened

Shares of C3.ai (AI 0.89%), the software-as-a-service platform that delivers artificial intelligence (AI) capabilities to enterprise-level customers, were surging last month after another round of hype around AI seemed to push the stock higher.

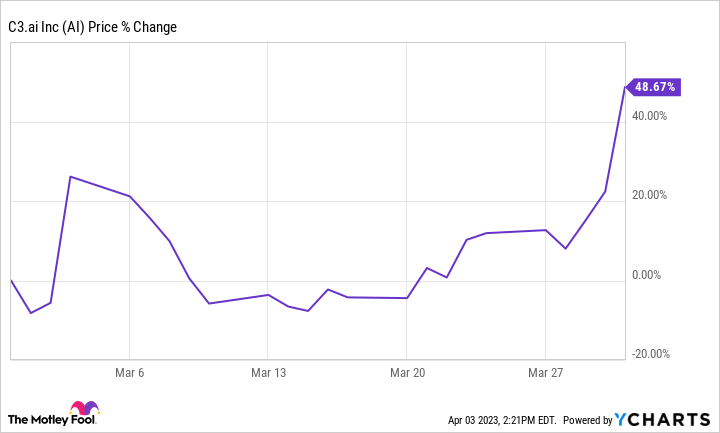

According to data from S&P Global Market Intelligence, the AI stock finished the month up 49%. As you can see from the chart below, the bulk of those gains came at the end of the month after Elon Musk, Steve Wozniak, and other tech luminaries signed an open letter urging a pause in AI research for fear the new technology can do more harm than good. The stock also jumped at the beginning of the month after the company reported fiscal third-quarter earnings.

AI data by YCharts.

So what

C3.ai shares initially gained 34% on March 3 after the company reported fiscal third-quarter earnings. The results themselves weren’t particularly impressive, but still managed to beat analyst estimates.

Revenue in the quarter fell 4.4% to $66.7 million but still beat the company’s own guidance and the analyst consensus of $64.3 million.

On the bottom line, the company reported an adjusted loss per share of $0.06, which was ahead of analyst estimates at a loss of $0.22.

CEO Thomas Siebel also touted increasing interest in the company’s products and said it expected to be cash positive and profitable on an adjusted basis by the end of fiscal 2024.

Analysts largely raised their price targets in response to the earnings report and the stock’s recent gains.

However, in the following session, Kerrisdale Capital said it was short on C3.ai, saying it believed that the “speculative flames” around generative AI wouldn’t burn bright for much longer. It also called out C3.ai’s poor customer traction, failing sales partnerships, and financial pressures.

The stock fell sharply over the subsequent week as that and news about the banking industry’s struggles pushed the stock to its lowest point during the month.

Lastly, the stock surged toward the end of the month as the open letter calling for a pause in AI development seemed to attract another round of attention to the sector, and shares jumped on high volume on the last day of March as fund managers seemed to buy the stock to show it off on their books at the end of the quarter in a phenomenon known as “window dressing.”

Now what

C3.ai has arguably received more attention than any other AI stock in the hype that followed the launch of ChatGPT.

The stock is now expensive at a price-to-sales ratio of 15, and it’s still generating significant losses, despite its promises of breaking even next year.

While the company might have some disruptive potential, investors should be aware that it faces considerable risks given its valuation and weak performance.