What happened

Shares of Intel (INTC 0.67%) were on the rise today, up as much as 2.7% today, before falling back to a modest gain as of 12:21 p.m. ET. Still, that was much better than the rest of the semiconductor sector, as defined by the iShares Semiconductor ETF (SOXX -0.86%), which was down 1.5% at that time.

Intel’s outperformance can be chalked up to an analyst upgrade from one of the more bearish Intel-watchers on the street. It wasn’t exactly an enthusiastic take, but it did reinforce the fact that the recent 8.3% rally in Intel shares over the past week may have something to it.

So what

This morning, Bernstein semiconductor analyst Stacy Rasgon upgraded Intel from a “sell” to a “hold,” while raising his price target from $20 to $30, compared with Intel’s current price of around $32.61 today.

That may not seem like such a big deal, as Rasgon isn’t exactly bullish. Still, when one of the more bearish analysts on a stock gets incrementally more optimistic, it could be the start of a trend.

Rasgon appears to think a bottom is in for Intel’s results, which have been absolutely dismal for the past year or so. The PC market experienced its worst year-over-year declines in recent history late last year, and data center spending also slowed markedly. Combine that with the fact that Intel had fallen behind competitors on leading-edge production and lost market share, and it’s no wonder Intel fell further than the rest of the sector in the 2022 bear market.

Rasgon is therefore very reluctantly upgrading Intel’s shares on the premise that things aren’t getting worse. “We hate this call but think it’s the right one,” he noted in today’s note, further elaborating, “While things still look bad, tactically we believe the medium-term setup is, finally, improving a bit, as the company’s issues are known, and numbers (for the first time in a while) may be low enough to stand.”

The change of heart is likely due to two things. First, while the PC and data center markets are not exactly in great shape, some think that the PC market may be hitting a bottom right now, and others think the same for the data center market.

In addition, it appears Intel just might be getting its act together with its product roadmap. The long-delayed Sapphire Rapids data center processor is finally shipping after nearly a year-long delay. Furthermore, Intel just held a presentation last week that presented an optimistic timeline for its product roadmap this year and next.

With Intel’s aggressive timeline for new chip releases stated to be on track, at least according to management, 2023 could potentially bring a recovery, as long as Intel follows up on that roadmap with execution. That hasn’t been the story of Intel for the past decade, but perhaps the company is finally getting its act together under CEO Pat Gelsinger, who took over in February 2021.

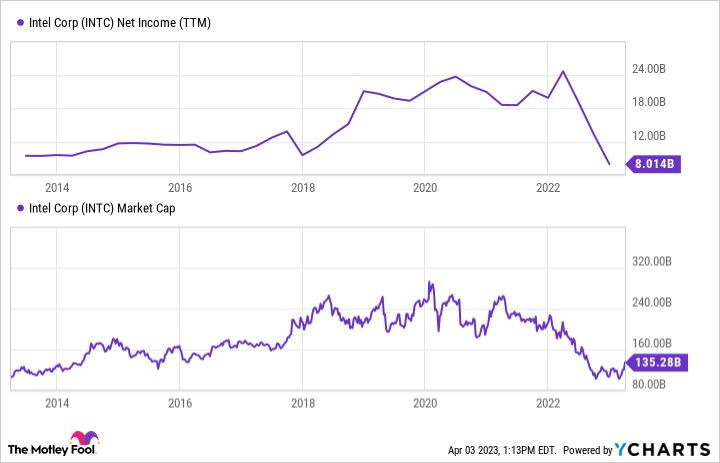

INTC Net Income (TTM) data by YCharts

Now what

Before the recent plunge in its results, Intel’s net income peaked around $24 billion a couple of years ago, and its market cap is currently $135 billion today, or about 5.6 times those peak earnings figures. So, if Intel can get back to prior profitability, the stock obviously looks cheap.

But has Intel seen its peak earnings? The company will have to gain back market share in PCs and the all-important data center market, which is where artificial intelligence applications may drive growth in the coming years.

However, Intel is also pivoting its business model to become an outsourced foundry for third parties. That takes a lot of capital, with an uncertain payoff. So Intel is having to play catch-up with its process technology, and it is also looking toward a more capital-intensive business as its next chapter of growth.

That’s why Intel forecast negative earnings for the current quarter, and the company will likely also burn cash in 2023, after having a negative free cash flow of about $9.4 billion last year.

So while Intel’s stock looks cheap if those two big projects work out, things are still highly uncertain — hence, why Rasgon’s optimism remains pretty tepid.