What happened

Shares of high-growth software companies CrowdStrike Hodings (CRWD -6.62%), MongoDB (MDB -6.51%), and Atlassian (TEAM -5.71%) fell hard today, declining 6.6%, 6.5%, and 5.7%, respectively, at the close.

It’s curious that these stocks fell so much, as today saw the release of soft economic data and a decline in long-term Treasury bond yields. Usually over the past year, days like this would have led unprofitable growth stocks like these three to outperform. Yet today, they are underperforming.

Why might that be? Well, perhaps investors are coming around to the notion that these “growth stocks” might not see such great growth this year or next. Data releases today pointed to an economic slowdown, and CrowdStrike held an analyst day yesterday that might have underwhelmed some more-hopeful investors. That could have cast a pall over similar software stocks like MongoDB and Atlassian today.

So what

Starting with CrowdStrike’s analyst day presentation on Tuesday, management provided investors with information that analysts appeared to like from a product and competitive point of view, but it might have underwhelmed investors regarding the medium-term growth and profit outlook.

In the presentation, CrowdStrike provided investors with some interesting information, including its No. 1 market share in endpoint protection, which is where 70% of all data breaches occur and 90% of all successful cyberattacks happen.

Yet despite CrowdStrike’s No. 1 position, it still only has 17.7% of the endpoint protection market, according to IDC. That leaves lots of room for growth. Specifically, the company took dead aim at Microsoft (MSFT -0.99%), its most significant competitor, saying that enterprise customers choose CrowdStrike over the Windows giant 8 out of every 10 times when they test head-to-head.

With all this positivity, why might investors be selling the stock today? Well, in this age of higher interest rates and recession fears, investors could be sharpening their models to focus on more near-term results, as opposed to growth stories in companies with large market opportunities.

On that note, CrowdStrike outlined a goal of $5 billion in annualized recurring revenue (ARR) in fiscal 2026, which ends in January of 2026. That’s nearly double the $2.56 billion in ARR for the year just ended in January 2023. A doubling in three years equates to just a 26% average growth rate, which is certainly not bad, but well below the 48% growth seen last quarter and the 50%-plus growth realized earlier last year.

Moreover, CrowdStrike still guided for 20% to 22% adjusted operating margins as part of its long-term model, to be achieved in 2025. However, those “adjustments” don’t factor in the company’s significant stock-based compensation, which totaled $526 million last year, up from $310 million in the prior year.

If stock-based comp keeps rising in conjunction with revenue, it’s possible CrowdStrike still won’t be making any profits under generally accepted accounting principles (GAAP) in fiscal 2026, even if it does achieve its target adjusted — or non-GAAP — operating margin by then.

In any case, it’s hard to pinpoint an exact reason for the tech sell-off today, especially since long-term bonds came down. Perhaps investors might be fearing that profits in these types of software-as-a-service companies could be further away than previously thought.

Both MongoDB and Atlassian have similar profiles to CrowdStrike in this sense. MongoDB is disrupting the huge enterprise data base market with its document-based architecture, and has also been seeing breakneck top-line growth along with large GAAP profit losses.

Yet its growth has also decelerated markedly last quarter to the mid-30% range, and its full-year guidance only implied 17% growth or so this year.

Atlassian guided for somewhat better growth of 25% this year, but also for its GAAP operating margin to be negative 11%.

Investors may be getting impatient for these companies to deliver profits, especially as the economy appears to be slowing down rapidly. Today, the Institute of Supply Management Manufacturing Purchasing Managers Index (a monthly gauge of economic activity in the manufacturing sector versus the previous month) and Automatic Data Processing employment estimates from March each showed slower-than-expected growth in the services sector and payrolls.

Therefore, we could be getting to the point where economic bad news might actually be bad news for technology growth stocks, which had been assumed to be able to grow right through a downturn. Also keep in mind that these stocks, while down significantly from their highs, had rallied to start the year. So it’s not a surprise to see them give back some of those gains.

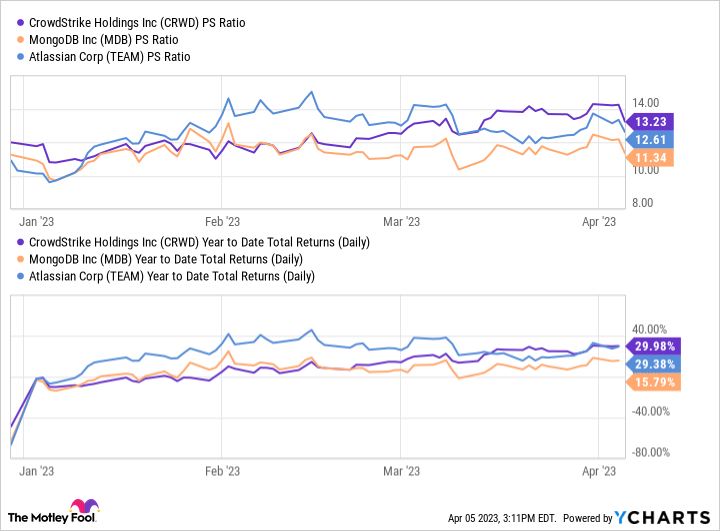

CRWD PS ratio data by YCharts. P/S = price to sales.

Now what

CrowdStrike, MongoDB, and Atlassian are all high-growth companies with compelling products in large total addressable markets (TAMs). CrowdStrike anticipates its TAM to reach $158 billion in 2026, when it projects just $5 billion in revenue. For MongoDB, Market Research Future projects a $101 billion data base market by 2030, compared with MongoDB’s guidance for just about $1.5 billion in revenue this year.

Still, these markets are fairly fragmented, with significant competition in each. If these up-and-coming software disruptors can continue to gobble up market share through the latter part of the decade, these stocks could be good buys on the dip. However, with revenue decelerating and near- and medium-term forecasts underwhelming, that appears to be harder for investors to envision today.