What happened

Shares of C3.AI (AI 8.30%) crashed as much as 39% this week, according to data from S&P Global Market Intelligence. The enterprise artificial intelligence (AI) software provider was presented with a short report from Kerrisdale Capital asking its auditor to investigate major accounting irregularities with the publicly traded company. The short-seller believes C3.AI is masking a declining business by faking revenue from large shareholder and customer Baker Hughes.

The stock is still up over 100% year to date as its ticker, AI, has encapsulated the current AI bonanza in public markets. But don’t think this means you should mount up and buy the dip on one of the market’s favorite AI stocks of 2023.

So what

The Kerrisdale report presents a pretty damning case with C3.AI’s financial statements. Without getting too bogged down in the details, the company alleges C3.AI is likely committing fraud for a few reasons:

Its accounts receivable line item from related party Baker Hughes has ballooned over the past year, which is atypical for a software provider and indicates it is faking revenue to please Wall Street.Management is inflating the company’s gross margins by putting expenses that should go into “cost of revenue” into the operating expense line item.The company has cycled through four chief financial officers (CFOs) in four years and now has a 39-year-old CFO with no CFO experience.

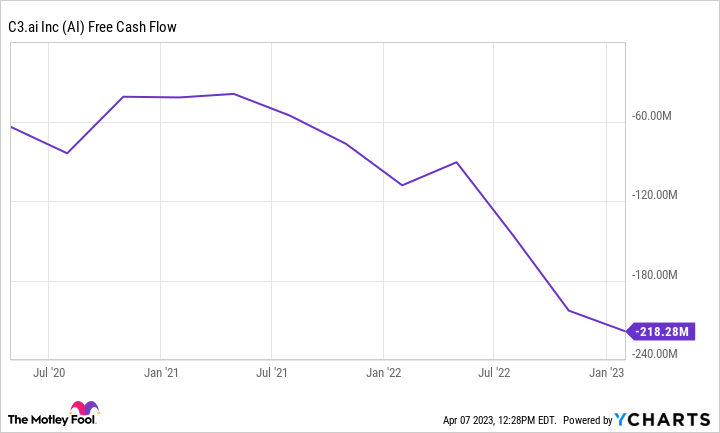

So even though C3.AI is reporting “revenue” and high gross margins, its free-cash-flow chart looks incredibly ugly:

AI Free Cash Flow data by YCharts.

Good software companies turn earnings into cash flow. This is not happening at C3.AI. Kerrisdale believes C3.AI’s auditors need to investigate these confusing accounting choices and potentially book the company for securities fraud. If true, it could mean a massive downside for C3.AI shares from these levels and a potential 100% wipeout of the share price.

Now what

If C3.AI has been fraudulently manipulating its financial statements, it is time for believers in the stock to sell their shares. Kerrisdale Capital makes a pretty darn strong case with its short report and letter to the company’s auditor. You can’t trust a management team that tries to put lipstick on a pig. So even if you believed the AI story management was feeding you, it is probably best to sell your shares of this enterprise AI upstart that is up over 100% so far this year.