What happened

Shares of Alibaba (BABA -1.17%) were moving higher last month after the Chinese tech giant announced a plan to break up the company.

That decision comes after the stock has swooned in the face of COVID-19 lockdowns, sluggish growth, and a crackdown by the Chinese government after founder Jack Ma made critical remarks about Beijing finance ministers.

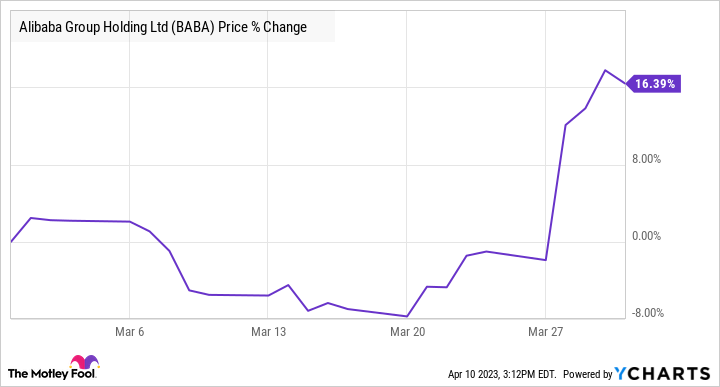

According to S&P Global Market Intelligence, the stock finished the month up 16%. As you can see from the chart below, those gains came entirely at the end of the month after Alibaba announced the breakup news.

BABA data by YCharts.

So what

In a brief statement, Alibaba said it was restructuring its business into six separate companies to be more agile, enhance decision-making, and enable faster responses to market changes.

The six divisions it will split into are:

1. The Cloud Intelligence Group, including cloud computing and AI.

2. Taobao and TMall, its e-commerce businesses that contribute most of its revenue.

3. Local Services, including food delivery.

4. The Global Digital Business Group, made up of foreign-focused e-commerce businesses like Lazada and AliExpress.

5. Cainiao Smart Logistics, its China-based logistics operation

6. The Digital Media and Entertainment Group, including streaming services like Youku.

Alibaba also said that each group will have the flexibility to raise its own capital and be able to seek its own initial public offering, with the exception of the Taobao and Tmall group, which will remain a part of Alibaba.

Investors cheered the announcement since it seemed to solve many of the problems that have plagued the company over the last two years as Beijing has cracked down on big tech companies with too much influence, like Alibaba and Tencent.

At the same time, the move gives investors the opportunity to own shares of the parts of Alibaba that they are most bullish on.

Now what

Even with the breakup, the underlying Alibaba business is still struggling due in part to Covid-related restrictions.

In the December quarter, revenue rose just 2% as the company blamed weak demand as well as supply chain and logistics disruptions from COVID restrictions for the slow growth.

Based on conventional metrics like the price-to-earnings (P/E) ratio, Alibaba looks cheap at a P/E of just 14. If the company returns to its earlier growth rate and erases the valuation discount associated with the crackdown risk, the stock could have significant upside potential.

Still, it might take Alibaba time to regain investor trust after the last two years.