What happened

Shares of Carvana (CVNA 6.00%) sank by as much as 16.6% this week, according to data from S&P Global Market Intelligence. A report from Bloomberg News said the company’s large group of debtholders would prefer the company file for bankruptcy, which would be terrible news for shareholders of the common stock. As of this writing, shares of Carvana are down 8% this week and off a whopping 98% from all-time highs.

Here’s what the future may hold for the struggling online used car marketplace.

So what

Carvana’s stock boomed by more than 1,000% during the pandemic bull market (or, as some might call it, the bubble). Customers were flocking to the used car website, driven by Carvana’s intuitive buying and selling processes. What’s more, with used car prices soaring due to supply chain shortages, Carvana was earning extra profits when it bought a car from one individual and sold it to another a few months later on its marketplace.

Now all those pandemic tailwinds have turned into headwinds. Used car affordability is up considerably with higher interest rates, prices have fallen from all-time highs, and customers have gone back to other ways of buying used automobiles. This caused revenue to decrease by 6% in 2022, with gross profit declining by a whopping 35%.

Carvana also has a huge debt problem, which is addressed in this Bloomberg article. At the end of 2022, it had over $6.5 billion in long-term debt that is now trading at a significant discount to fair value. Earlier this year, Carvana offered a discounted buyout to these bondholders to salvage some value from the debt. However, owners of the debt, like Apollo Global, apparently balked at the idea.

The bondholders are also upset that Carvana marked its car auction subsidiary in a way that will enable it to raise even more debt. All in all, the Carvana debtholders are not happy at the moment and seem intent on charting a course toward bankruptcy unless the company can turn things around soon.

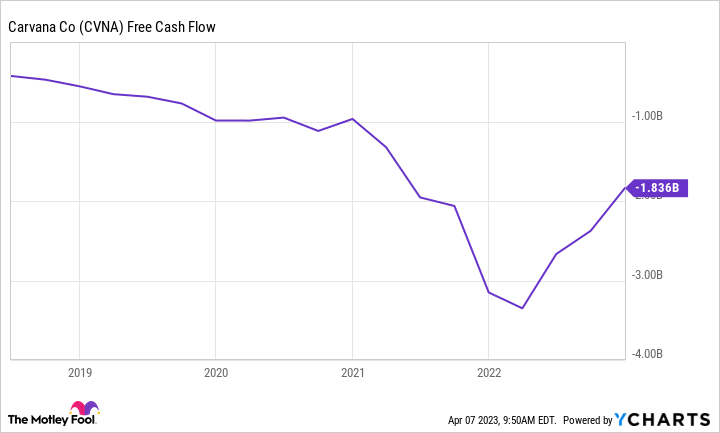

The problem is that Carvana has never generated a profit. Even during the height of the COVID-19 pandemic, it burned $1 billion in free cash flow yearly. At one point last year, its cash burn hit $3 billion. Today, it is at a burn rate of $1.8 billion annually. This is incredibly value-destructive for the business, so it is not surprising to see the stock in the gutter and bondholders calling for a bankruptcy filing.

CVNA Free Cash Flow data by YCharts.

Now what

Carvana has never generated a profit, its business model is clearly flawed, and it has a mountain of debt on its balance sheet. The bond sharks will fight it out to see how much value they can salvage from this corporate entity, but things look bleak for shareholders of the common stock. 100% downside is a material risk to shares, even though they are already off 98% from all-time highs.

Smart investors should take heed and avoid this risk-laden equity. Put your hard-earned money into safer stocks instead.